Paypal Business Loan Things To Know Before You Buy

Wiki Article

Some Known Facts About Paypal Business Loan.

Table of ContentsThe Ultimate Guide To Paypal Business LoanThe 9-Minute Rule for Paypal Business LoanA Biased View of Paypal Business LoanIndicators on Paypal Business Loan You Should KnowNot known Facts About Paypal Business LoanThe Buzz on Paypal Business Loan

Many company owner report feeling worried when requesting a tiny organization lending. It appears that loan providers are asking for an increasing number of paperwork with each passing day. In fact, the majority of lenders have a typical discovery listing of files that are needed to obtain as well as refine a finance. PayPal Business Loan. Knowing which papers will be needed and getting that documents in order before you look for your business car loan can minimize your stress and anxiety and speed-up authorization of your loan.Be prepared to give up to 2 years of background. Not all lending institutions will call for two years on all documents, however many will not require even more than that. PayPal Business Loan. In any type of case, be prepared to equip all asked for documentation.

The Definitive Guide for Paypal Business Loan

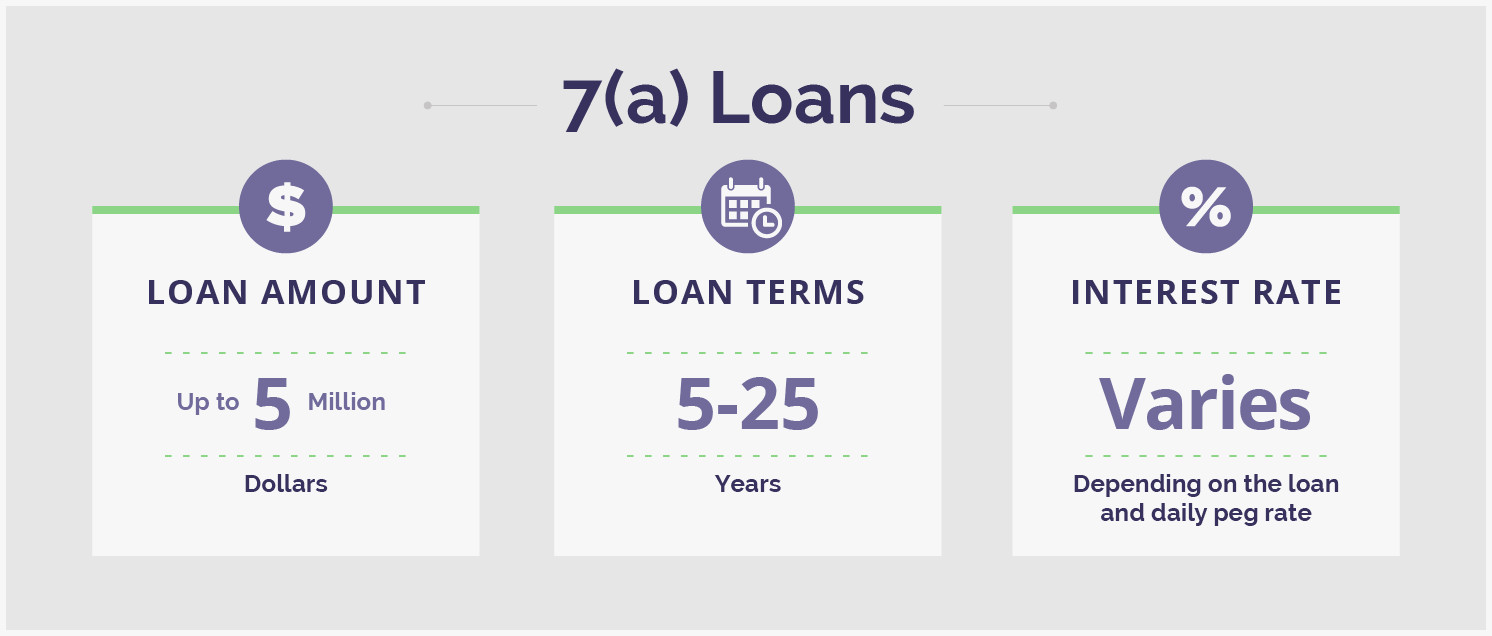

You can pick from a variety of organization lending types as well as ought to investigate your alternatives to locate the ideal fit. Consider the kinds of small-business loans you can pick from: SBA car loans. The SBA partially backs financings from lending partners, reducing their risk and also boosting accessibility to resources for little businesses.

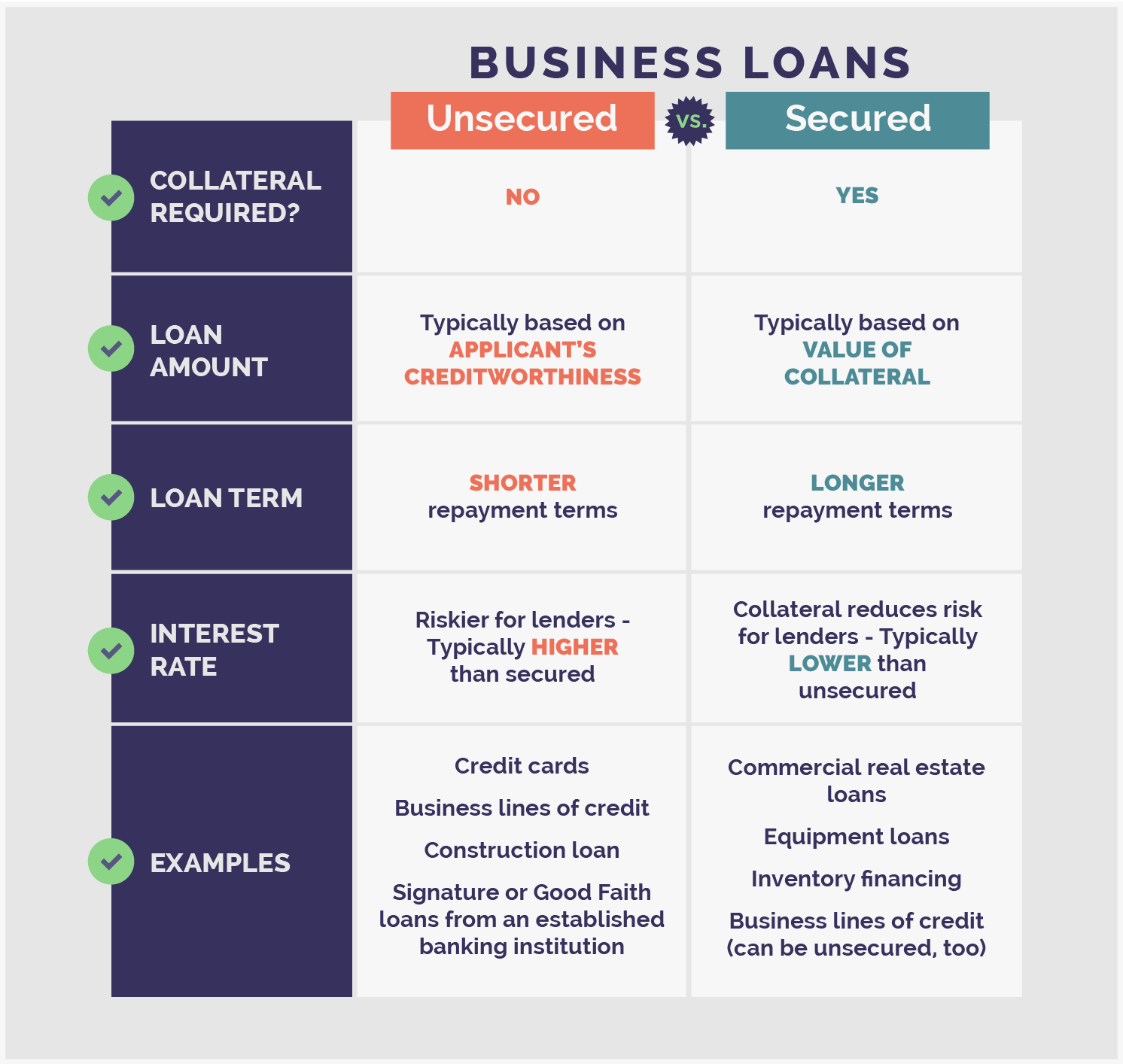

Devices funding is a kind of term finance that can be made use of to acquire as well as spread out the price of equipment or tools for your business. Usually, the devices is security for the lending. If your small business deals with capital since you're waiting on invoices to be paid, you can use invoice funding, additionally understood as factoring.

Paypal Business Loan Can Be Fun For Everyone

Particular energy-efficient or making jobs might receive greater than one 504 funding of as much as $5. 5 million each. These low-interest lendings made straight by the SBA can be used to recoup from a stated calamity. Organizations might utilize calamity fundings to repair or replace machinery and also tools, inventory, as well as realty that was damaged or destroyed.Lots of small-business finances can be used for a range of organization needs. Considerable documents needed. Small-business car loan applications can call for a good deal of documents, which might make the process lengthy. Limited choices with negative credit. Small-business funding applications are based in component on credit, and there are click for more info few finance alternatives for organizations with poor credit history.

Some on-line lenders are thought about alternative loan providers, which can supply more versatility than commercial banks since their financing items are less controlled. Alternate lending institutions give car loans to debtors that or else may not have access to small-business financing, such as startups or organizations with an unsteady economic background."Small companies ought to be conscious there are several networks available for borrowing needed funds," says S.

Online lenders may offer SBA provide programsFinance

For instance, you may get a different financing for pay-roll than you would certainly genuine estate. If a lending institution does learn the facts here now not provide financings in the quantity you require, discover one that will. Working out for a lower quantity can concern you with a loan that drops brief of sufficiently addressing your resources demands.

Paypal Business Loan Things To Know Before You Get This

Temporary service loans have higher monthly repayments than long-lasting car loans, yet you will usually pay much less in total rate of interest because you have the car loan for much less time. The opposite is likewise real. A longer payment term might mean lower monthly settlements but more in overall interest fees over the life of the funding.Look for a loan provider with the most affordable prices, consisting of: The annual percent rate is the rate of their website interest billed on your lending yearly, plus all costs and also costs connected with the finance. Keep in mind that advertised passion rates may be where rates start; a price check can approximate an APR for your small-business loan.

In some cases, the deposit for your small-business car loan is covered by collateral. Various other small-business financings call for an equity financial investment. Deposit demands differ, however anticipate to invest at least 10% to 30% of your own funding when securing a loan. Factor rate. An element price is usually made use of for merchant money advancements as well as short-term business lendings to identify how much you will owe in interest.

The 6-Minute Rule for Paypal Business Loan

Individual finances. Some personal loans are based upon credit rating background, and may not provide as much financing as small-business car loans. Family members fundings. If relative are able, you may inquire to financing you money for your service. Household lendings can conserve you money on rate of interest, yet they ought to still include a clear settlement strategy.Advertising factors to consider may affect where deals show up on the website but do not affect any type of editorial decisions, such as which car loan products we write about and how we examine them. This website does not include all finance firms or all funding supplies readily available in the industry.

Sometimes, a bank loan is the response to help you achieve your organization goals. Before you begin completing applications, however, you'll wish to have a fundamental understanding of the bank loan landscape: what funding alternatives are available, which ones are popular, and also exactly how they work. In this overview, we'll cover those fundamentals as well as some alternatives worth taking into consideration.

Report this wiki page